The Retirement Income Portfolio That Grows Year After Year

It was as much a surprise to StreetAuthority’s co-founder as it was to us. As an experiment, he tried to build a personal portfolio of dividend paying stocks to see if he could get 30 dividend checks in a month. But he achieved far more than the joy of receiving dividends every day. And all he did was simply enroll his securities in an automatic reinvestment program through an online brokerage account.

And before long, our little experiment was beating the market.

| —Recommended Link— |

| The #1 Pot Stock To Buy Now |

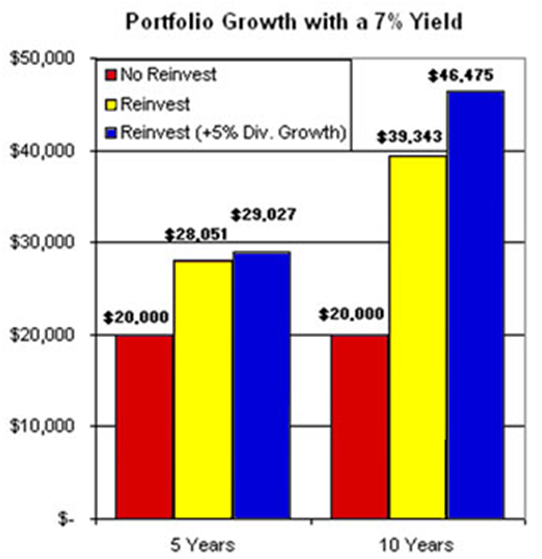

Of course we were familiar with the power of the compounding growth of dividend reinvestment. As you can see from the chart below, if you invested $20,000 in securities paying a 7% yield, after 10 years your portfolio would be worth $39,343 with reinvested dividends. And if your holdings happened to boost their dividends by just 5% annually — something even giant blue chip AT&T (NYSE: T) has been able to beat — your portfolio would be sitting at $46,475. That’s an increase of 132.4%. And that’s assuming zero capital gains. That isn’t bad, especially when you consider the S&P 500 Index lost 26.5% in the ten-year period ended in 2009.

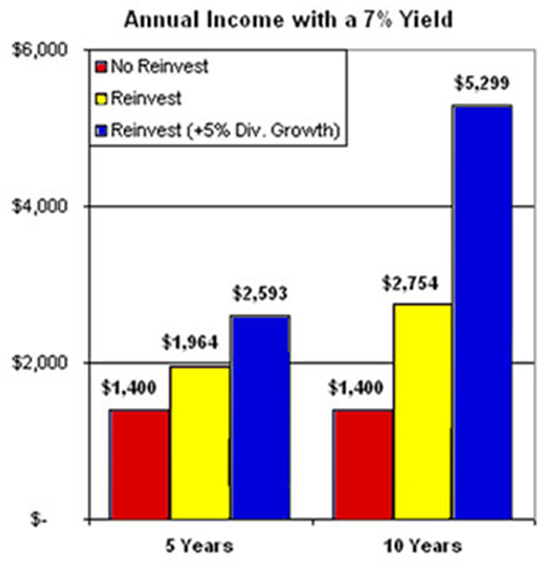

But the income part of the equation is even better. The chart below shows your potential annual income stream assuming a $20,000 initial investment. Thanks to the power of reinvested dividends and dividend growth, after 10 years your portfolio could be generating $5,299 in annual income — that’s 278.5% more income when compared to an investor who doesn’t reinvest. In fact, it could be generating an effective yield of 26.5% based on your initial $20,000 investment.

If you have even a little bit more time on your investment horizon (or more money to invest, or additional dollars to invest each year), then the numbers only get better. And keep in mind that these are conservative estimates.

While we understood the power of compound growth, we just didn’t realize that an income portfolio — even one with dividend reinvestment — had market-beating potential. Month after month we reviewed the results. Before long, we realized some unique benefits of the portfolio he had built…

It was less volatile than the overall market. For investors who were tired of losing sleep over big swings in their portfolio, it offered a less bumpy ride. And after the financial meltdown of 2008, most investors were in need of a good night’s sleep.

It was a particularly nice transition strategy for Baby Boomers. Boomers are at or nearing retirement. They need a strategy that can turn their growth portfolios into portfolios that generate income. Our portfolio beat the overall market, while also continuing to increase income potential over time.

After we launched The Daily Paycheck, we found even more followers than we anticipated. Retirees liked the above-average yields for current income. Recent college graduates, with a long investment horizon, also loved it. With little disposable income, they viewed it as a safer way to start investing.

Why We Absolutely Believe In This System

Before starting The Daily Paycheck, many of us were anxious about creating a portfolio that could support people after retirement. But there is nothing like the test of time. We’ve now spent nearly 10 years using The Daily Paycheck strategy, and we love its simplicity. Our subscribers do, too.

A large number of them have been with us since the launch of The Daily Paycheck back in December 2009. They watched as we slowly transformed the $200,000 model portfolio into the $397,000 portfolio it is today.

New subscribers are now greeted with a portfolio of more than 50 securities. Our dividends get reinvested every month without having to lift a finger. Overall, the portfolio has been roughly 37% less volatile than the overall market. That represents 37% more sleep-filled nights for subscribers.

Our portfolio generates more and more income every month. And when retirement comes, people can just flick off the dividend reinvestment switch and start living off the income.

The result? Our subscribers are no longer anxious about retirement, and you don’t have to be either. If you’d like to learn more about The Daily Paycheck system and join us for the ride, click here.