Why “Game-Changing” Investments Deserve A Place In Your Portfolio

There are a lot of ways to make — and lose — money in the markets.

Some investors might use options, while others might find them too confusing and risky. Some folks might play it safe with a conservative index fund or even bonds. Others might instead focus on the high-growth biotech or technology sector. The list goes on and on.

Each method has its advantages and disadvantages. But regardless of which approach someone uses, I have found that a good majority of investors all have the same thing in common. They all have the same expectations — that they will strike it rich in the market.

This is why so many people gamble on some “hot tip” or penny stock that is sure to make them a fortune overnight. The idea of risk management is thrown out of the window. But as I’ve said before, investing in the market is the hardest way to make easy money. Trust me, I’ve tried my hand in just about every corner of the market… stocks, bonds, options, futures, warrants… You name it, I’ve likely invested in it.

I’ve made good money using options or speculating on futures and currencies. But of course, I’ve also lost money as well. As exciting as these things can be, it can also be extremely frustrating and nerve-racking… not to mention a quick way to lose money.

But despite what I usually preach, that doesn’t mean there isn’t a place for it. I’ll explain what I mean in a moment…

Take Care Of The Basics First…

Through it all, some of my most profitable trades have come with the least amount of stress. Some might find it boring, but it works. For example, one of my best-performing stocks is an insurance company that I purchased back in 2010. The stock is up over 630% since then and I have no plans of selling.

Over at Capital Wealth Letter, my premium service, I can cite you numerous examples of incredibly profitable “boring” long-term positions we’ve had, from Hershey to Visa to Starbucks… they all crushed the broader market during the time we held them in our portfolio.

I don’t tell you this to brag. My goal is to simply point out that investing this way can be quite profitable. These are companies that I don’t have to worry so much about every earnings season. They are well-established businesses that will be around for years to come. They generate large amounts of free cash flow and reward shareholders through dividends and share repurchases. They are the type of stocks around which you can build your portfolio.

But here’s the thing… they aren’t “sexy” stocks that will make you rich overnight.

These aren’t the kinds of investments I get asked about by friends and family. Those would be pot stocks, or cryptocurrencies, or some penny stock that trades over-the-counter. They are all disappointed when I try to tell them that I think Alphabet (Nasdaq: GOOGL) is undervalued. Or that we’ve done quite well with insurance stocks or credit card companies.

The truth is, while these folks would be better off with these kinds of stocks, they simply aren’t exciting enough for them.

What these folks are really looking for is what I call a “Game-Changer”.

Why You Should Look For Game-Changers…

Now, I know that I just pounded the table on purchasing wonderful companies at fair prices. And believe me, stocks like this deserve a place in just about every investor’s portfolio. But once you have these “core” holdings in place, there’s nothing wrong with keeping some cash on hand to take a “home run” swing occasionally.

In fact, just one or two of these homeruns a year can really add some extra juice to your portfolio over time. Even better, your core holdings should make it a lot less painful whenever you “strike out” (and believe me, you will). What’s more, shorter-term aggressive trades usually tend to be not as correlated to the broader market.

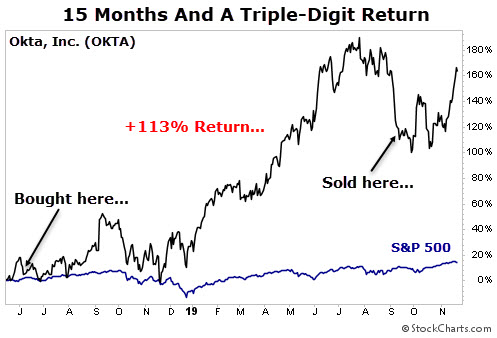

A trade my readers and I made with Okta, Inc. (Nasdaq: OKTA) is a great example of this. This smaller company doesn’t turn a profit or reward shareholders with increasing dividends. It’s a growth stock that operates in the burgeoning and increasingly important cybersecurity space.

We held Okta for just over a year (we booked our profits in September 2019). And during that span we greatly outperformed the broader market:

This brings me to the second advantage of having part of your portfolio dedicated to shorter-term opportunities: It recycles capital quickly. This is good, because it allows you to move on to other trades. Even better, if a market downturn comes, you’re more likely to have the cash on hand to buy elite businesses at a discount to their true value.

Action To Take

My advice: If you have a stable of solid “boring” stocks like the ones I’ve described above, there’s nothing wrong with that. Keep at it. But do yourself a favor and consider incorporating the occasional short-term “Game-Changer” into your strategy.

Of course, not every pick will be a home run. But go into each Game-Changer trade with a plan. Know the downside risk and have certain price points that will be your line in the sand. If your investing thesis is off, or your timing is off, do not hesitate to cut it for a modest loss and move on to the next promising idea.

If anything, you’ll learn some valuable lessons along the way. And on the upside, well, let’s just say that booking a few triple-digit returns each year never hurt anyone’s brokerage account.

If you’re looking for a “game-changer” to add to your portfolio, then you don’t want to miss this…

I’ve been researching the “next investment frontier” in tech for the past few months. And I’m convinced this is the next big thing…

I’m talking about the commercialization of outer space. It’s not as crazy as it sounds — in fact, it’s already happening. Companies are scrambling to win the race, and I’ve discovered a unique “backdoor” way we can gain exposure. And if we’re right, it could lead to some of the biggest gains of our lives.