3 Investing Rules That Are Better Than “Buy-And-Hope”

This won’t make me popular, but it’s something you need to hear: Buy-and-hold investing is a bit of a fallacy.

Now before you send me angry emails, hear me out.

When I’m looking for a company to invest in, I’m not looking for some fly-by-night firm hoping that it becomes the next Google. Hope is not a good strategy and investing in the stock market is not a get-rich-quick scheme. I’m looking for a company that I can partner with. In return for my equity stake in this partnership, I expect to be rewarded for putting my hard-earned money on the line.

And so should you.

I think we can all agree on that. But consider this: If you started a business venture with a friend or relative, and that business was losing money hand over fist, would you continue pouring your savings into it?

At first, maybe. Perhaps you feel an emotional attachment — or sense of loyalty. But at some point, you’ll need to cut your losses and move on.

Investing in the stock market is no different.

Where Buy-And-Hold Can Go Wrong

But most folks who believe they are buy-and-hold investors end up being “buy and hope” investors. They continue to hold onto a losing position for years just hoping the stock gets back to their entry price so they can break even. The truth is nobody knows what the future holds. Every company goes through ups and downs, and during those down cycles, we don’t know how long it will be until the firm turns it around — or even if it will turn things around.

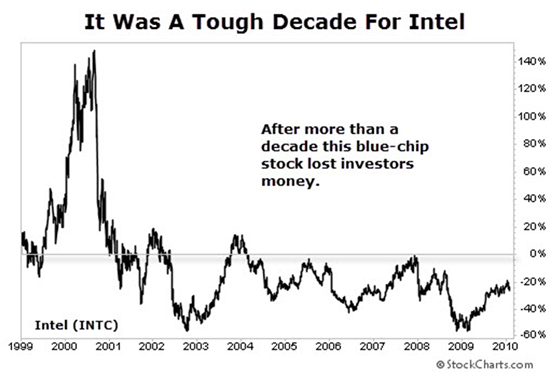

Just ask anyone who invested in Intel (Nasdaq: INTC) back in 1999. They probably believed they could buy this “safe,” solid blue chip and hold it for years. Surely they would be rewarded.

Yet, after more than a decade you can see how well the “buy and hold” strategy performed:

That’s a long time to be invested in a company that went nowhere. More important, that’s a lot of time that you’ve lost…

We can make up a 15%, 20% or 30% loss, but we can’t make up for lost time.

3 Guidelines To Follow

This is why instead of using the “buy and hold” strategy as a blueprint for investing, you should instead consider these guidelines:

1. Have an exit strategy in place.

Whether it’s a hard-stop loss or a trailing-stop loss, you need to know your “pain” point. This helps minimize your losses and takes the guesswork and emotion out of investing.

2. Understand and use position sizes.

Most folks are familiar with the saying, “Don’t put all your eggs in one basket.”

This mantra very much applies to investing. No one stock should make up a large portion of your portfolio. The general rule of thumb is a position size of between 2% and 5% for any single holding.

Over at Capital Wealth Letter, we allocate a modest position for every addition we make to the portfolio. Because guess what… although I’d put our track record up against anybody, sometimes we’re wrong. If a stock takes major hit, it’s not as detrimental to our entire portfolio.

For example, a couple of years ago, we closed out a position on AutoZone (NYSE: AZO) for a loss of roughly 30%. Ouch. But while that kind of loss hurts, but because we followed this guideline, we only lost about 1.8% of the total portfolio.

That’s much easier to stomach than putting all my eggs into that stock.

3. Keep your emotions out of the market.

This is probably the toughest one to follow, and thus, the most important. Emotions have no place in investing, which is why it’s important to follow rule No. 1 (exit strategy). I would say that emotion is the single biggest reason why average investors don’t even come close to beating the market.

Investing is not a competition. There are no prizes for winning, no gold medal, or blue ribbon. But there are severe penalties if you lose.

Action To Take

Now, in an ideal world, we want to follow the advice of Warren Buffett, who famously said that his ideal holding period is “forever”. But guess what… even he doesn’t always meet this goal.

And my goal isn’t simply to provide you a plethora of stock picks. My job is to help you become a better investor and assemble a portfolio that can assist you in building your wealth for generations. In order to do that, yes, we need winning picks. But we also need to avoid simply telling ourselves lies, like “I’m a buy-and-hold” investor.

Instead, we need to be realistic. We also need to follow consistent guidelines for our strategy so that, in the event we’re wrong (and we will be, sometimes), we’ll live to fight another day.

Editor’s Note: Are you one of the millions of Americans that have noticed some “strange” lights shooting across the sky?

Do you have any idea what they are? They’re NOT military drones… stars… or UFOs. They’re the next frontier in big tech and it could hand early investors the gains of a lifetime…

Jimmy Butts and his team have been researching this phenomenon closely for months… Their findings are nothing short of “shocking” — and they’re saying now is the time to strike.